Finn Carew of developer Native Land examines the barriers.

It is no secret that London is facing a severe housing shortage. While the city needs an estimated 83,000 new homes per year, we are building less than half that.

London’s population is growing fast. Over the last 10 years it has grown by an additional 1.2 million (or 15 per cent) and it is projected to continue to continue to grow at a similar rate in the near future. At the same time, the city’s housing stock has grown by only 322,000 (or 9 per cent). Centre for Cities, a think tank, estimate that in the 10 years up to the pandemic there were 0.2 homes constructed for every additional resident in London versus 1.4 in Paris.

Residential supply in London is set to decline further as the number of homes obtaining planning permission, according to Greater London Authority data, has shown a steep decline from 92,000 in 2015 to only 32,000 last year. This represents the lowest level of permitted units in at least twenty years. The supply of housing is one of London’s most pressing problems.

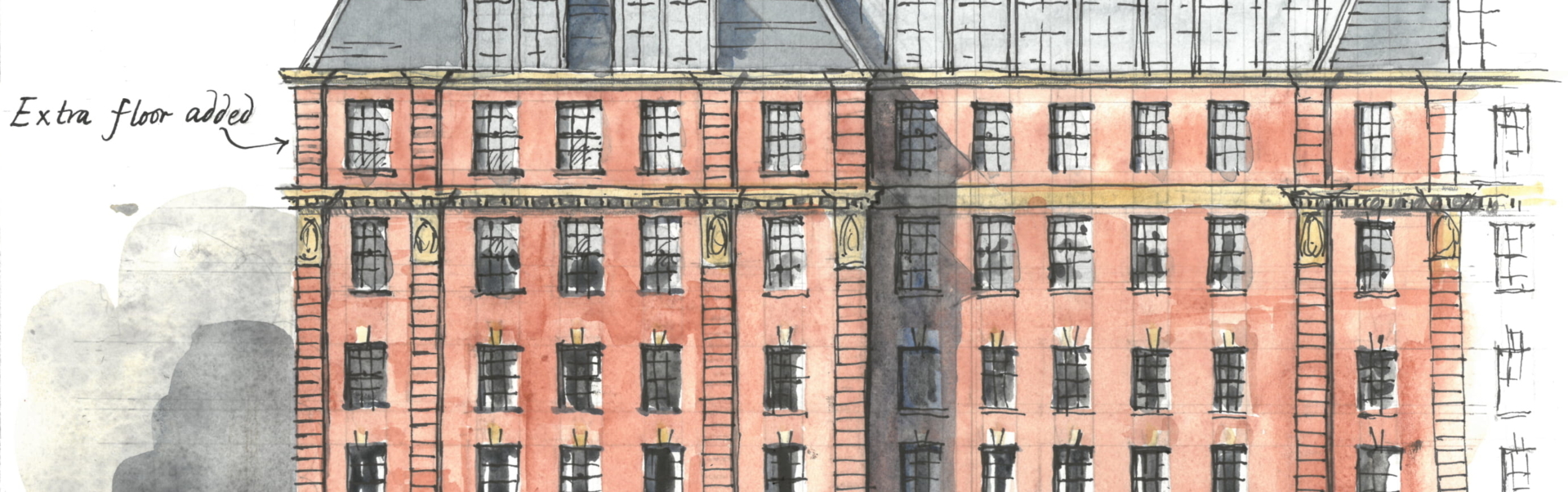

Resolving the issue is complex and will require significant compromises and shifts in planning policy. One potential solution is the conversion of vacant and underutilised offices to residential use.

The pandemic brought about profound changes in the office market. It accelerated pre-existing trends towards working from home and increased demands for much higher environmental performance in buildings. It drove expectations for better-quality, more inspiring workplaces.

The result is that large swathes of office stock have become unlettable and effectively obsolete. Vacancy rates in offices across London are running at 9 per cent, the highest in 20 years. This has been primarily driven by low uptake of poor-quality older space.

This should create perfect conditions for large scale office-to-residential repurposing projects but very few residential conversions are taking place in London, in stark contrast to cities like New York which actively encourage conversions. From the start of 2022 to May 2023 CBRE, a property consultancy, estimated that only 84,000 sqft of central London office space was purchased with the intention of conversion to residential. This is the rough equivalent of 120 apartments, a very small number. There are two primary reasons for this.

First, Local Authority protections of office space have become steadily more stringent across central London. In Westminster, for example, office-to-residential conversion within the Central Activity Zone is only allowed where “the proposal would reinstate an original residential use.” This is an extremely burdensome and narrow restriction. The intention of the policy is to ensure enough employment space is provided within the borough but blunt protections of this type lack the flexibility needed to provide the right type of space in the right locations. New fit-for-purpose office developments (or substantial refurbishments) should be allowed to replace tired, environmentally unfriendly, poor-quality, and often ugly workspaces. Where the existing office building, or its location, are sub-optimal for continued office use, residential repurposing must be seen as a credible alternative.

Similar policies are seen across other central London boroughs. The contradictory nature of these policies can lead to bizarre results. In Camden existing office space is strongly protected while, in recognition of housing shortfalls, all new office buildings and extensions over 1,000 sqm must be half residential and half office. Old offices are therefore preserved while new office developments are thwarted, as it is often undesirable or impractical to mix office and residential uses within a single building.

The second factor is the provision of at least 35 per cent on-site affordable housing. This is not to suggest that we reduce our ambition for affordable housing, which provides a vital lifeline to those unable to access the housing market. It must be recognized, however, that these are inescapable trade-offs. The high levels of affordable housing demanded and the insistence that it is on site, makes many conversion schemes unviable, thus perversely reducing overall residential supply across all tenures including new affordable homes. The policy is only applied to residential which penalises housing over other potential uses such as hotel or life sciences.

Office-to-residential conversion has the potential to rejuvenate areas of London with high concentrations of vacant offices. It is beneficial from an environmental perspective, saving on substantial embodied carbon. Neither does re-purposing have to lead to a lower overall quantum of office space in London. New office developments and refurbishments across the city are set to deliver better quality offices that are fit-for-purpose in a post-Covid world. The conversion of unsuitable older offices will, however, require far more planning flexibility on these matters. The need for policy to catch up with the market is urgent.

Finn Carew heads the Investment function at Native Land, a central London focussed mixed-use developer.